Subchapters

Recruitment by J. Roderick MacArthur

Rod MacArthur and The MacArthur Foundation

Hiring Lawyers

Copyright and Trademark Mastery

Hammacher Schlemmer

Bradford Then and Now

Rod MacArthur and The MacArthur Foundation

Hiring Lawyers

Copyright and Trademark Mastery

Hammacher Schlemmer

Bradford Then and Now

Richard Lawrence Gwinn, Sr.(4th Georgia Volunteers)

Bradford Exchange and MacArthur Foundation logos

Bradford CEO and MacArthur Foundation director J. Roderick MacArthur with me at my 1979 wedding

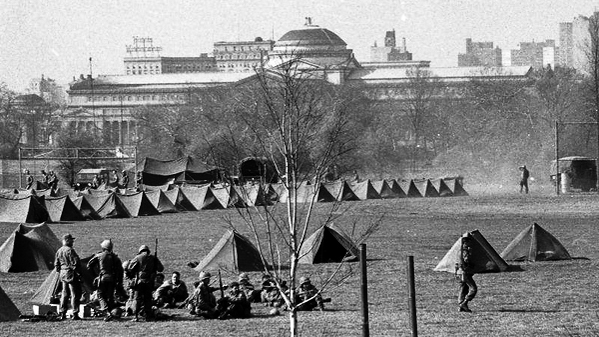

Chapter 2

Becoming a General Counsel

I put the Army in my rear-view mirror at the beginning of the 1970s and got busy. It was an eventful decade. I returned to work as a lawyer, this time for the newly formed law firm of Roan, Grossman, Singer, Mauck & Kaplan (later Roan & Grossman). The Singer in the firm was Bill Singer. We had both been associate attorneys in the law firm I was briefly with before the Army. When the Army assigned me to Washington, D.C., I took Bill up on his suggestion that I look up his sister-in-law, Judy Arndt, then working on the Hill on one of the Congressional staffs. When I married her in 1974, Bill and I were briefly brothers-in-law.

Also in 1974, I took a leave of absence from my law firm to serve as General Counsel and Research Director for Singer’s mayoral campaign as he took on Chicago’s long-time Mayor Richard J. Daley and his political machine. With the anti-machine vote split among several candidates during the Democratic primary election, Singer lost. However, Daley’s winning margin had sharply dropped from his last election. Daley went on to win another term as Mayor in the 1975 general election, but for the first-time cracks had appeared in the Daley juggernaut. With the campaign over, I returned to the Roan & Grossman law firm and made partner at a younger age than was the norm at the time.

When my mother died in early 1979. I was divorced and living in a townhouse on Larrabee Street in Chicago’s Lincoln Park neighborhood. In my social life, I had been dating Cathy Vanselow for a while, having been introduced to her by a friend from Bill Singer’s mayoral campaign. I was thinking seriously of asking her to marry me.

This was the lay of the land when a litigator friend at Roan & Grossman sprung on me a job opportunity he thought would fit me. He said one of his former professors at Northwestern University Law School had asked him if he knew anyone who might be interested in becoming general counsel of a fast-growing direct mail company. He said he had immediately thought of me, and I should let him know if I were interested. I was initially curious about the opportunity but not particularly excited when I learned the company mostly sold plates of some kind or another.

Then I learned that the business involved was owned by the son of John D. MacArthur, reportedly the second or third-richest man in the country when he recently died. The son, Rod MacArthur (J. Roderick MacArthur), was also a director of the John D. and Catherine T. MacArthur Foundation, the beneficiary of most of the senior MacArthur’s estate. Rod’s main business at the time was the direct marketing of collector plates. It had grown very rapidly in recent years and was now at a size where it would be more economical for it to have lawyers in-house rather than remain completely reliant on outside law firms.

Of particular interest to me was the fact that Rod wanted a lawyer at hand to advise him on his burgeoning dispute with his fellow Foundation directors. The prospect of being involved in this indirect way at the birth of one of the country’s largest foundations was an attractive aspect of the work. All of these items made the situation interesting enough to look into further. In short order, I met with 58-year-old Rod MacArthur and his 31-year-old Executive Vice President Kevin McEneely.

I was also intrigued and attracted to the idea of leaving private practice and getting more closely involved in the running of a business.

Also weighing in the balance was the fact that staying with the law firm was not without risk itself. Roan & Grossman in the 1970s had not grown at an exceptional pace, and, after being defeated in his run for mayor in 1975, Bill Singer had left to join the Kirkland & Ellis law firm.

This had taken away one of the firm’s better business getters for the future. Given that there was a real risk the firm might struggle in the future, I had to take that into serious consideration also in deciding whether to accept the offer to become The Bradford Exchange’s General Counsel.

Finally, much like my decision after leaving the Army to join Roan & Grossman instead of returning to the firm I started with, I decided to again leave the certainty of a prior, known experience for the unknown world of what lay ahead.

Keeping a toe in my last pond, I acceded to Roan & Grossman’s unforeseen request that I remain Of Counsel to the firm following my departure.

While fully committed to my career change, I figured that if life in my new position somehow went awry, keeping some form of tie to my old firm couldn’t hurt.

On this basis, I began my new job as General Counsel of The Bradford Exchange. The heart of the business of The Bradford Exchange at this time was selling decorative collector plates that were to be displayed on a wall or put on a knickknack shelf. They were not to be eaten off of or, God forbid, put in a dishwasher.

The rampant inflation afoot at the time was having a wonderful effect on the collectibles business of Bradford. With a modest aftermarket in the sale of collectible plates, the plate you bought for $29 the year before was often worth considerably more the next year.

This was not entirely a surprise. With the bill coming due for the extraordinary national expenditures during and after the Vietnam War, inflation in 1979 was running at over 11 percent. President Jimmy Carter would lose the election the next year in consequence.

Rod MacArthur & The MacArthur Foundation

When his father had died at the age of 81 in 1978, most of his wealth had been left to the Foundation in the form of his sole ownership of the Bankers Life & Casualty Co. His longtime attorney, William T. Kirby, filed the incorporation papers for the Foundation in 1970 and later served as an officer and longtime director.

I knew a little bit about Kirby, having met his daughter Cathy when both of us were attending the University of Chicago Law School. When I asked her recently about her father’s hiring by John D. MacArthur and what his long relationship with MacArthur was like, she recalled that Paul Doolan, the Bankers Life house counsel, had first met Kirby when they were young and both had worked at the same summer resort in Lake County, Illinois.

Kirby later became a well-known attorney nationally for successfully representing carmaker Preston Tucker in a celebrated 1950 lawsuit. The Securities and Exchange Commission had sued Tucker for fraud in raising money for his Tucker Corporation. Then later in the 1960s, when MacArthur needed a lawyer to handle a legal question for Bankers, Doolan recommended Kirby. Doolan thought Kirby would be an economical hire because he had recently researched similar issues when he prevailed against Albert E. Jenner, Jr., another prominent Chicago attorney, in an Illinois Supreme Court case involving similar questions. Kirby was hired, but what cemented the long-term relationship with MacArthur was the fact that his bill for services rendered was unexpectedly modest, just as Doolan had predicted.

As his daughter described MacArthur’s reaction, “When Dad sent John a low bill, he called, amazed, and asked if that was really all he wanted. He won over John by his cheapness.” MacArthur was indeed a notorious skinflint. The Bankers Life headquarters offices had expanded into an older low-rise apartment building on Lawrence Avenue on Chicago’s northwest side. When the building’s apartments were converted into offices, the kitchens and bathrooms were left intact to save the expense of removing them.

Oddly enough, MacArthur was not the only billionaire to ever make money by focusing on plumbing. Another wealthy Kirby client was A.N. Pritzker. His billionaire grandson, J.B. Pritzker, elected Illinois governor in 2018, tried an approach opposite to MacArthur’s. During his campaign, it was revealed that, to expand his residential meeting space, J.B. had paid $3.7 million to buy an adjacent house on Chicago’s tony Astor Street. By removing the house’s toilets, for a time he was saving over $300,000 a year in real estate taxes by claiming the building was “uninhabitable.”

With John MacArthur’s strong desire to keep his estate from being largely consumed by the 70% income tax prevailing in the 1970s, Kirby’s recommended option of leaving the bulk of his estate to the Foundation prevailed.

Rod’s son, John R. “Rick” MacArthur, longtime publisher of Harper’s Magazine, talked about his family’s relationship with his grandfather in a 2003 interview with his alma mater’s journal Columbia College Today. He explained he had grown up believing his family would inherit nothing:

MacArthur says he believed it when his grandfather “announced he was disinheriting us at an early age. My father told us, seriously, ‘Do not expect to get a dime from him. You’re going to have to work.’ They didn’t get along, even though my father worked for him for a long time.”

According to The Eccentric Billionaire, a 2008 biography of John D. MacArthur by Nancy Kriplen, this was not the case prior to the Foundation’s organization in 1970. Kriplen writes that before that time MacArthur’s earlier will left half of his estate to his wife Catherine, with the second half split between his children from his first marriage, Rod and Virginia. In the book, Kriplen also describes William Kirby’s role in pointing out to Mac Arthur that this structure was a disaster from a tax and estate planning perspective, with most of his accumulated wealth going to pay taxes. A corollary of this prior structure was that applicable taxes could only be paid through the prompt sale or break up of Bankers Life & Casualty, the enterprise that was MacArthur’s life’s work.

Kirby’s daughter added that her father had urged MacArthur to not completely disinherit his children Rod and Virginia. “He always told us that he had to insist that John leave something to his children.” And indeed, though modest compared to the Foundation’s bequest, both children ended up with substantial legacies.

The Foundation is mostly known for its annual program of giving large cash grants to creative individuals with no strings attached. The idea behind the program came from a noted internist and heart specialist at Tulane University, Dr. George Burch. While those receiving these grants are formally known as MacArthur Fellows, the media consistently refers to the stipends as the “genius grants.”

In 1989, Kirby gave a lot of credit to Rod MacArthur as he explained how the program came into being in the early days of the Foundation with John D. MacArthur newly deceased:

Immediately after his death, our small Foundation Board discussed possible programs, and I told them of Dr. George Burch’s idea. … From the very beginning, Rod MacArthur was enthusiastic about the idea and supported it vigorously. No doubt about it, I am happy to testify, Rod MacArthur was the chief implementer of the details of the Fellows Program, and its strongest supporter throughout the remainder of his life. I don’t mean the other Directors were not fully supportive, but the dynamism and dedication burned brightest in Rod. One can say, in all honesty, the MacArthur Fellows Program, as it stands today and as all of you have benefited from it, is a tribute to both George Burch and J. Roderick MacArthur. Rod, as you know, died in 1984.

This is certainly my recollection as well, as I remember many meetings in Rod MacArthur’s open office at The Bradford Exchange as he consulted with a disparate group about the best way to structure the program and the Foundation’s possible bailout of Harper’s Magazine. The people he met with included Ken Hope, his assistant and later the first director of the MacArthur Fellows Program, as well as a number of academics and administrative experts. I also recall being detailed one day to pick up Gloria Steinem and a Ms. magazine colleague at O’Hare Airport. I drove them back to meet with Rod and sat in on the discussion. I remember they seemed more interested in soliciting grant money than pondering the Foundation’s issues. They made it perfectly clear they had important and valuable ideas about possibly sharing details of favorable tax arrangements they were familiar with if grant money was on the table for Ms.

The senior MacArthur had two children with his first wife, Louise, Rod and his sister, Virginia. He had separated from Louise when Rod was six and later married his then-secretary, Catherine T. Hyland.

The second Mrs. MacArthur was closely involved in the growth of his insurance empire and real estate investments. For many years towards the end of his life, MacArthur conducted his widespread business affairs from a booth in the Colonnades Beach Hotel coffee shop in Palm Beach Shores, Florida. At his death, he owned more than 100,000 acres of prime real estate in Florida, much of it in Palm Beach County.

John MacArthur served in the U.S. Navy and Canadian Royal Air Force in World War I. He then had started working in an insurance company owned by his brother Alfred. A gifted salesman, during the Depression he had bought a failing insurance company. He later grew this into his estate’s main asset, Bankers Life and Casualty Co. Over the decades that followed, with multiple acquisitions and shrewd real estate investments, he had turned Bankers Life into a successful and enormous insurance giant.

In the course of my interviews with both Rod and Kevin, I was treated to their thrilling tale of how Rod had started the company while working for his father at Bankers Life. When the little collector plate company began to take off, Rod had to wrest control of the enterprise away from his father.

The struggle had included hijacking plate inventory from a warehouse and, in the telling, ultimately freeing Rod in his middle years from decades of subordination and tight control by his father.

While the story supposedly had a happy ending, with father and son fully reconciled before his death, I had my doubts. It smacked of being a better tale for public consumption than the likely reality. Rod’s stories of his life working for his father were mostly focused on his having consistently achieved business breakthroughs that went unrecognized and unrewarded by his father. Rod MacArthur’s struggles with the Foundation’s initial board of directors loomed large following his father’s death, and it certainly appeared a major dispute over the management of the Foundation would be unfolding.

In a way, Rod’s later blood feud with his father’s business associates on the Foundation’s board of directors was nothing but a continuation of the rancor between father and son that had persisted through the decades that Rod had worked in his father’s Citizens Bank and Macmart businesses as well as Bankers Life itself.

William Hoffman’s book The Stockholder, a 1969 unauthorized biography of John MacArthur, paints a picture of a very warped father-son relationship. When the Foundation later came to publish a history of the MacArthur family, The MacArthur Heritage, it dismissed Hoffman’s work as “a sensationalized version of John’s life [that] should be read more as entertainment than as historical fact.” While some of Hoffman’s reconstructed dialogs in the book seem a stretch, for me this account has a ring of truth to it:

John considered it a personal affront that Roderick’s interests ran in a different direction from his. He put his son to work for Bankers Life, then took pleasure in publicly insulting him at every opportunity. Often, in front of other employees, John would relate tasteless tales of Roderick’s ineptitude. Many times…John would leave his office to scream down the corridor: “Hey, you worthless little son-of-a-bitch, get your lazy ass up here.”

Hoffman had apparently spent time in the Banker Life organization as editor of one of its publications. This would have put him in a position to be privy to at least some of the internal gossip of the day. He offers this account of Rod in his middle years:

Roderick’s middle-age has been spent bouncing from psychiatrist to psychiatrist, joining peace organizations, drinking, and perhaps trying to commit suicide. Once he plunged into a swimming pool and had to be bailed out. Another time he ran his car headlong into a tree on the PGA golf course, spent half a year recuperating. Roderick still works at Bankers, though his duties are vague, and is either feared or scorned by fellow employees. Those who know only that he’s the owner’s son believe he has great power over their careers and accord him a feigned deference. Others, usually higher-ups, know the father’s feelings about the son and treat him the way their boss would want.

Hoffman, unlike Kriplen, offers no sources or footnotes for the reader to consult and I must say I never saw any behavior akin to this in my time working with Rod at Bradford. Thus, some or all of this may properly fall outside the factual realm and into the categories of made up, hearsay or rumor.

The last chapter of Hoffman’s book is somewhat different in that it purports to recount a direct conversation the author had with John MacArthur in 1968 in the coffee shop of the Colonnades hotel. In his later years this is where the senior MacArthur lived and worked. Hoffman later told people he had lived for several weeks at the Colonnades while researching his book. In the exchange Hoffman writes that he asked John MacArthur about his son Rod:

“What about Rod?”

“You talk to him?”

“Yes.”

“Damn. Is it necessary to dredge up unpleasantness? Why not just tell about what I’ve done? That’s how people measure a man and that’s what they want to know. Hell, though, you’re a sensitive fellow. I’ll level with you and let you decide. Okay, Rod’s disappointment to me. I had great plans for him. Bankers could have been his. And all of the other things. But if you talked to him you know that’s impossible. He’s got no sense at all. Would rather waste his time reading and attending classes. Christ, he’s forty-eight years old. Forty-eight years old and he’s going to class. Shit. I attended the school of hard knocks. But I blame myself. I should have taken him by the neck and made him do what was right. Now it’s too late. He’s a drinker and he’s messed up mentally. It’s the thing that makes me saddest. It would be nice to know as I grow older that my own boy would take over what I started. So---things aren’t as sweet as they seem.”

Hiring Lawyers

I got extensive experience at Bradford in managing litigation outside the United States. Bradford’s collector’s plates were usually made from isolated kaolin clay deposits in China, Japan, and Europe. With artwork on decals applied, they were then fired in limited, numbered volumes and delivered to Bradford in the U.S. for sale around the world. Bradford would then export them from the U.S. for sale by its own subsidiaries or other local dealers. When the plates crossed the border at this point, a customs declaration of their value was made when the imported plates came in bulk into the country of ultimate sale.

At one point, Canadian customs authorities disputed the value assigned to Bradford’s imports, claiming it was losing customs duties that were due as a result. After concluding the Canadian valuation calculation Customs made was faulty, I went shopping in Canada for a lawyer there who could represent the company in putting forth its arguments. At the time in Canada and other British Commonwealth countries, lawyers weren’t just lawyers, they were either solicitors or barristers and never the twain did meet. Solicitors generally only did office work, though they might appear as advocates in lower courts. Barristers were trial lawyers and had a monopoly on trying the bigger cases in the trial and appellate courts. This meant I needed a barrister.

Early in my search, I discovered a subset of barristers known as Queen’s Counsel. This group turned out to be where I found my lawyer. These advocates are appointed by the Canadian Minister of Justice. All were senior trial lawyers who were recognized for their contributions to the legal profession and public service with the Queen’s Counsel (Q.C.) designation. Later in my career with Encyclopaedia Britannica, I also had a chance to be similarly guided through major disputes in trial and appellate courts of the United Kingdom and Australia.

Before Rod MacArthur sued his fellow directors of the John D. and Catherine T. MacArthur foundation, he had asked me for guidance in finding a premier trial lawyer. I took Rod on a round of interviews with several of Chicago’s most prominent attorneys. I began by introducing him to Albert Jenner, a founder of the Jenner & Block law firm. Jenner struck both Rod and me as not right for the job. He clearly seemed to be in declining health and lacking the mental acuity of his better days.

Kirkland & Ellis was also on the list to talk to. When I was in law school and beginning to interview firms for a clerkship, my father’s brother, Augustine J. Bowe, had left the Bowe & Bowe law firm to become the Chief Justice of the Municipal Court of Chicago. He suggested I ask for an appointment with one of Kirkland’s founders, Weymouth Kirkland.

When I expressed doubt as to whether Kirkland would take time to see lowly me, Gus said not to worry. He said he and Weymouth had known each other for decades. I later discovered that these contemporaries had met not as leading Chicago lawyers who might have met as allies or adversaries, but because Gus and his wife, Julia, had bumped into Kirkland and his wife, Louise, on summer trips to France in the 1920s. As Gus predicted, Kirkland did take time to see me.

With the Kirkland firm on my list for the current assignment, I introduced MacArthur to its most prominent litigator of the day, Don Reuben. Reuben was much in the public eye, having such diverse clients as the Chicago Tribune and Time and sports teams such as the White Sox, Cubs, and Bears. Add to them the Illinois Republican Party, the Catholic Archdiocese of Chicago, and Hollywood personalities Zsa Zsa Gabor and Hedda Hopper. Reuben wasn’t hired then, but not long after I left Bradford, Rod finally did sue his fellow MacArthur Foundation directors, Rod was represented by other Kirkland & Ellis trial lawyers. Reuben was out of the picture at that point because not long after Rod and I met with him, he had been canned by the firm in what the Chicago Tribune called “an act of back-stabbing plotted while Reuben was on a European vacation.”

Copyright and Trademark Mastery

The marketing of collector’s plates involved a good deal of intellectual property law. The plate designs were mostly protected by copyright laws that prevented the artistic work from being copied. Bradford had created a magazine concerned with the hobby. Its content needed copyright protection, too.

These were done with filings in the Copyright Office of the Library of Congress. Then there were the names of the many subsidiary companies that sold the various collector plates. “Bradford” and the names of these businesses had to be trademarked. This was accomplished with filings in the Patent and Trademark Office of the U.S. Department of Commerce and with various state government offices.

This concentration and hands-on training helped guide my career as an intellectual property lawyer when I later served as General Counsel with United Press International, Inc., and Encyclopaedia Britannica, Inc. During my tenure, Bradford had substantial litigation over copyright and trademark issues of the day. This marked the real beginning of my learning to manage complex intellectual property disputes. At Bradford, these disputes usually involved lawsuits either asserting copyright or trademark infringement or defending against these kinds of claims. In the landmark copyright case, Gracen v. Bradford Exchange, 698 F.2d 300 (7th Cir. 1983), Judge Richard Posner’s opinion for the 7th Circuit Federal Court of Appeals upheld Bradford’s defense of a copyright infringement claim against it. The lawsuit involved a painting of actress Judy Garland in MGM’s famous movie The Wizard of Oz. Posner’s opinion was memorable both for its erudition and its setting of an important legal precedent.

Hammacher Schlemmer

As I began work for Bradford in 1979, Rod MacArthur was directly engaged in the management of the company, but he was increasingly spending his nine-to-five hours doing other things, including working on his growing dispute with his fellow directors of the Foundation. By the time I left the company, he was spending less and less of his time on Bradford matters and turning up less and less at the company’s offices in the Chicago suburb of Niles. Nonetheless, during this period he had acquired the well-known, New York City-based retail and catalog business of Hammacher Schlemmer & Co. from Gulf + Western.

At the time of Rod’s acquisition, Gulf + Western was one of America’s largest conglomerate companies. As we entered its building at the foot of Central Park, we passed through a group of nuns protesting outside. They were apparently unhappy with Gulf + Western’s policies in the West Indies. The company owned thousands of acres in the Dominican Republic replete with sugar plantation and cattle. When Bradford had won the auction for Hammacher, Gulf + Western’s president, David (Jim) Judelson, asked the two of us to join him for lunch in his private dining room at the top of the building. As the elevator arrived at the executive suite, two armed security guards with weapons drawn were there to greet us. If the nuns downstairs weren’t the threat, Gulf + Western certainly thought it had bigger unseen enemies lurking about.

The small dining room had large windows offering spectacular views of Manhattan. At the time, Gulf + Western was only a tenant in the building, not its owner. Its owner, oddly enough, was Bankers Life & Casualty Co., the massive insurance corporation established by John D. MacArthur. It was the primary asset willed to the MacArthur Foundation upon his death. Knowing that Rod was MacArthur’s son and a director of the Foundation, Judelson joked that if the window blinds needed to be repaired, he now knew who to call.

Not long after Bradford closed the purchase of Hammacher, the Foundation, under a legal requirement to divest its operating businesses, sold the Gulf + Western Building and 18 other New York properties for over $400 million. In time, Gulf + Western fell apart, and in 1994, architect Philip Johnson oversaw the renovation of the building, and it was reopened as the Trump International Hotel and Tower.

Bradford Then and Now

Rod MacArthur had primarily bought Hammacher to expand its mail order catalog business. Founded in 1848, Hammacher remains America’s oldest-running catalog. Before long, he had added to Hammacher’s sole retail operation in New York City stores on Chicago’s “Magnificent Mile” on Michigan Avenue and on tony Rodeo Drive in Beverly Hills, California. Today, only the Manhattan retail store on 57th Street survives. Bradford’s original collector-plate, mail-order business has been vastly expanded to a whole range of other collectibles. The product line now includes décor, jewelry and watches, apparel, bags, shoes, miniature villages and trains, music boxes, die cast cars, Christmas ornaments, dolls, coins, $2 bills, personal checks, and stationery, not to mention Disney, Star Wars, NFL, and Harry Potter collectibles. Along the way, the company has also changed hands, from Rod MacArthur’s heirs to its employees. A Bradford history written in 2006 explained the company’s origins this way:

Contrary to popular opinion, J. Roderick MacArthur, the entrepreneur and marketing genius who founded the Bradford Exchange more than three decades ago, did not invent collector plates. When, in a characteristically bold move, he launched what would become his Bradford Exchange by liberating his merchandise from his insurance-mogul father’s locked warehouse, what Rod MacArthur did was to understand the plate market in a new way. When the Bradford Exchange issued its first “Current Quotations” in 1973, listing the current market prices of all the most traded Bradford Exchange collector’s plates, it re-defined plates as a unique art commodity that is actively traded, with uniform buy/sell transactions, on an organized market. The original mission of the Bradford Exchange was simply to monitor the plate market. The ideal, however, was to create an electronic bid-ask marketplace, operating much like a securities market, where transactions could be made instantaneously. In 1983, such a computerized marketplace became a reality. However, with the new ease and increased volume of trading, the emphasis at the Bradford Exchange gradually shifted from monitoring the secondary market to creating and marketing an ever-growing variety of collectibles.

Of course, this version of the company’s history sugarcoats the reality of what was really going on in the late 1970s and early 1980s. Bradford’s marketing targets in selling collector plates were people with modest incomes who now could not only buy art like a real collector but then sit back and watch their wise plate investment go up in value.

Furthering the idea of plate scarcity, collector plates were primarily sold at the time as “limited editions,” never to be made again. The marketing of the collector plates before I arrived had been sufficiently aggressive to cause the federal Securities Exchange Commission to launch an investigation into whether Bradford was failing to comply with the securities laws.

The idea was that by implying the value of collector plates would likely increase in value without any effort on the part of the buyer, the plate might meet the definition of a security. Bradford had dialed back its advertising and avoided formal SEC action. In fact, it found an unexpected marketing upside to the SEC threat. Its promotional material could now proudly announce that collector plates were “not securities!”

However, the 2006 company history slid over the reasons Bradford had to diversify its product line beyond plates after 1983. The truth was that the plate market went south because the rampant inflation in the country that hit a high of 14.6 percent a year briefly in Jimmy Carter’s one-term presidency was plummeting by 1983 under his successor, Ronald Reagan. Inflation fell to 3.2 percent in 1983. The attendant recession of Reagan’s first term, coupled with inflation being tamed, simply killed the marketing theme that limited edition collector plates were likely to rise in value over time.

The collector plate runs were typically called “limited editions” because they were limited by number of “firing days.” Left unmentioned was that the industrial-scale kilns used in the transformation of clay blanks into decorative plates could produce in the specified firing days tens if not hundreds of thousands of plates.

Bradford sold collector plates in the 1970s and ’80s that were largely decorated with artwork in the public domain. This was to save the expense of having to pay commissions to an artist to create fresh works. Also, you could sell more plates if you put on plates preexisting pieces of art that were already known to the public. Fortunately for Bradford, it could use many of the illustrations executed by the well-known American master Norman Rockwell.

Earlier in the century, Rockwell had drawn covers for the Saturday Evening Post that had fallen out of the 28-year protection of the copyright law. Thinking there was no value in old magazines, their copyrights had not been renewed.

To sell its Rockwell collector plates, MacArthur decided to create a company other than Bradford to market them under a different name. Thus, he resurrected the name of a long-defunct West Virginia-based dinnerware maker. Soon the Edwin M. Knowles China Co. was selling the Norman Rockwell plates from the “Oldest Name in North American Fine China.” This was true enough even though the plates were actually fired in China.

The downside was that lots of other collectible companies were selling Rockwell-adorned merchandise as well. To distinguish itself from the crowd and elevate its Rockwell plates above the hurly-burly competition, Rod struck a deal with Rockwell heirs through The Norman Rockwell Family Trust to endorse the Knowles commercial effort.

Though the images remained in the public domain, paying a royalty for this Rockwell-related endorsement paid off handsomely for all concerned. With Rockwell recently deceased, and his work more popular than ever, selling the “Authenticated” Rockwell plates with the new Knowles trademark was wildly successful.

By 1983, Rod MacArthur was spending less and less time on Bradford business as his attention had continued to focus more and more on Foundation affairs. Responsibilities for the day-to-day management of the company increasingly fell to his young steward Kevin McEneely, by then 35 years old. Their relationship had been forged when McEneely had abandoned the Bankers Life mother ship with Rod and helped him spirit away the Bradford inventory from Rod’s father a decade before. While McEneely had had no specialized business training, he was personable, and with Rod calling the shots on the direction of the company, it was smooth sailing. With a financially astute President with an accounting background in place, McEneely had proven up to the job of being Rod’s second banana. However, when Rod abruptly fired Bradford’s current President, it quickly became clear that McEneely was not remotely capable of filling the gap. The concern began to drift, and problems built up.

As General Counsel, I reported directly to Rod, not McEneely. I increasingly thought that I had a duty to alert Rod to the gap I saw because it was one that was already beginning to have negative consequences. Initially, Rod was very concerned about the message I had conveyed to him and had arranged for a third party to take a deeper look at the state of the senior management. When interviewed as to what I thought the solution was, I said that besides the obvious option of an outside hire, the company had recently hired an executive to manage Hammacher, and I thought he had the skill set and breadth of experience to serve as the company’s chief operating officer under Rod.

When Rod did circle back to me on the subject, he made it clear that he was not going to replace his stalwart, at least not at that time. That meant that I was going to be hitting the road. Not wanting to wait for the ax, I quickly told him that it appeared he had lost confidence in my advice, and that I was offering my resignation. He seemed as relieved as I was that the conversation had been as brief and trouble-free as that.

As fate would have it, shortly after I left, Rod was diagnosed with pancreatic cancer and died after a brief illness. My own diagnosis of the serious management issues the company faced just months before was confirmed when the first thing his family did after his death was remove McEneely from the business and install the person I had pointed to as the only sensible internal candidate to replace him. While not right for Bradford at the time, McNeely went on to have an otherwise normal career with several other Chicago area companies.

After leaving Bradford, I briefly went back to private practice in the Loop. I had by that time dropped my affiliation with Roan & Grossman as Of Counsel and became Of Counsel to a firm recently started by two of my former partners there, Bill Cowan and Charles Biggam. I wasn’t there long, as I soon moved to Nashville with Cathy and Andy when I took on the job of organizing United Press International’s first internal law department as UPI’s Assistant General Counsel.

At the time, I was unhappy to have my work as Bradford’s General Counsel short-circuited in the way that it was. My brief return to private practice gave me time to rethink what my professional goals should be at that point. I almost immediately decided to pursue another position as an in-house counsel.

As it turned out, the Bradford experience led to a wild and demanding time helping guide UPI’s legal course as the company collapsed into bankruptcy.